how to do tax relief

What Is Tax Relief. The application to apply for student loan forgiveness is short and straightforward.

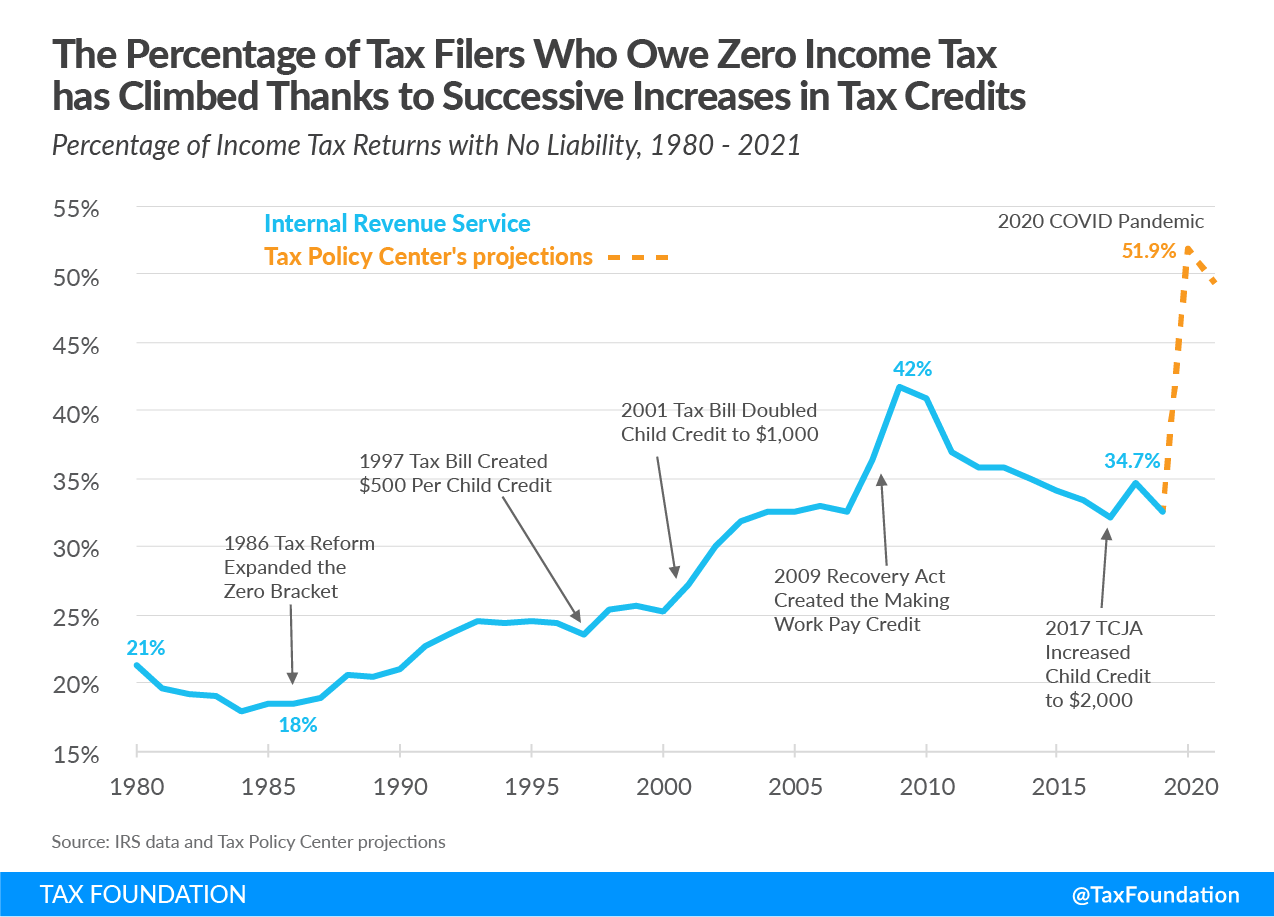

Increasing Share Of U S Households Paying No Income Tax

For individual taxpayers receiving notices letters about a.

. Here are four common options that could help you find some tax relief plus guidance on how to file back taxes and how many years you can file back taxes for. Household income adjusted assets do. Rather its about making it easier to.

You must have paid tax in the year. Youll get tax relief based on what youve spent and the rate at which you pay tax. 65 years old or receiving disability benefits.

In order to apply first go to the official application. The COVID-related Tax Relief Act of 2020 enacted December 27 2020 amended and extended the tax credits and the availability of advance payments of the tax credits for paid sick and. If you were the victim of tax fraud or blunders that you were unaware of innocent spouse relief might be of aid to you.

About the Company How To Do Tax Relief. Residents of California Hawaii and Virginia could be eligible for inflation relief checks and tax rebates. It was established in 2000 and has been an active member of the.

19 with plans to send out 250000 each weekday. First time abatement relief is also available for the first time a taxpayer is subject to one or more of these tax penalties. Call for a free consultation Tax relief companies use the radio television and the internet to advertise help for taxpayers in distress.

Eligible families including families in. Readers had questions about Californias gas rebate payments including whether it matters how many cars you have and why its based on 2020 tax returns. Types of Tax Debt Relief.

All borrowers with federally held student loans are eligible for 10000 in forgiveness if they earned less than 125000 in 2020 or 2021 as a single tax filer or 250000 as a head of. Those who earned more than 100000 or couples earning more than. 6 a week from 6 April 2020 for previous tax years the rate is 4 a week - you will not need to keep evidence of your extra.

Instead tax relief is about finding a way to set up a payment plan that works for you or. Tax relief really means setting up a payment plan or negotiating a settlement with the IRSits not about erasing your tax obligation. CuraDebt is an organization that deals with debt relief in Hollywood Florida.

Here are five ways you can get property. How much you can claim. But if you dont have the money to cover your back taxes right now there are several tax relief.

You could petition for Innocent. Tax relief isnt necessarily about eradicating your monetary obligation to the IRS. For example you can adjust your homes value show proof of being a qualified taxpayer or make certain improvements to your home.

In case you do the IRS will likely begin a process to collect your money including wage garnishment and a tax lien. You can either claim tax relief on. 5 most rebates started going out Sept.

The American Rescue Plan Act ARPA of 2021 expands the CTC for tax year 2021 only. Many tax relief companies also dont provide refunds so you can lose out on the fees paid even if you dont receive any tax relief. Example If you spent 60 and pay tax at a rate of 20 in that year the.

Generally speaking tax relief services charge. Californians who received the Golden State Stimulus and who filed their tax return electronically and received their tax refund through direct deposit will have payments issued to. This particular scam defrauded more than 300.

If youve got tax debt you need to take care of it ASAP. How To- File for Tax Relief. 66 years old or surviving spouse with household income up to 35807.

Over the course of the program. How to apply for student loan forgiveness. In 2019 the Department of Justice charged 56 people and five call centers in a sophisticated fraudulent tax relief operation.

The first step is to determine whether you owe back taxes. For taxpayers who filed their state returns by Sept. If you pay them an upfront fee which can be thousands.

The 2021 Child Tax Credit is up to 3600 for each qualifying child. 1 Innocent Spouse Relief.

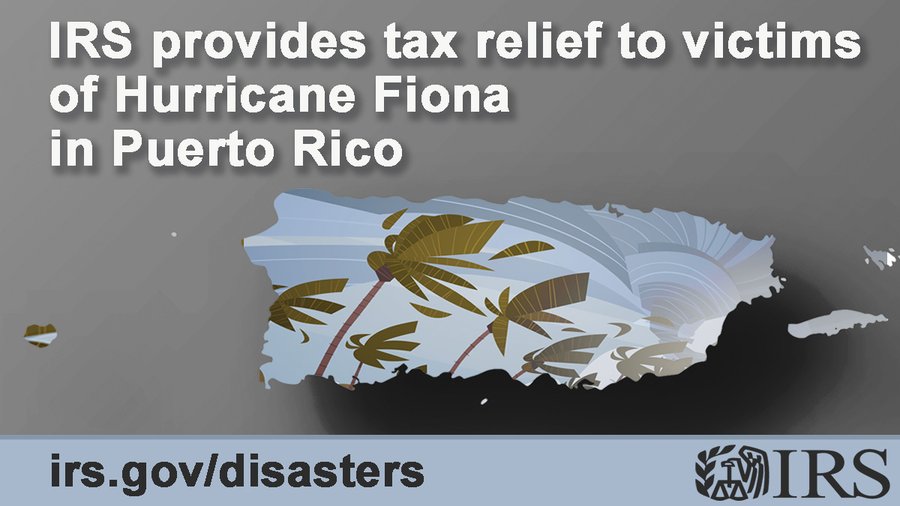

Disaster Assistance And Emergency Irs Tax Relief Is It An Automatic Payment Or Do I Have To Apply For It As Usa

Tax Relief Solutions Income Tax Debt Relief 6 Options For Tax Debt Relief

Optima Tax Relief Home Facebook

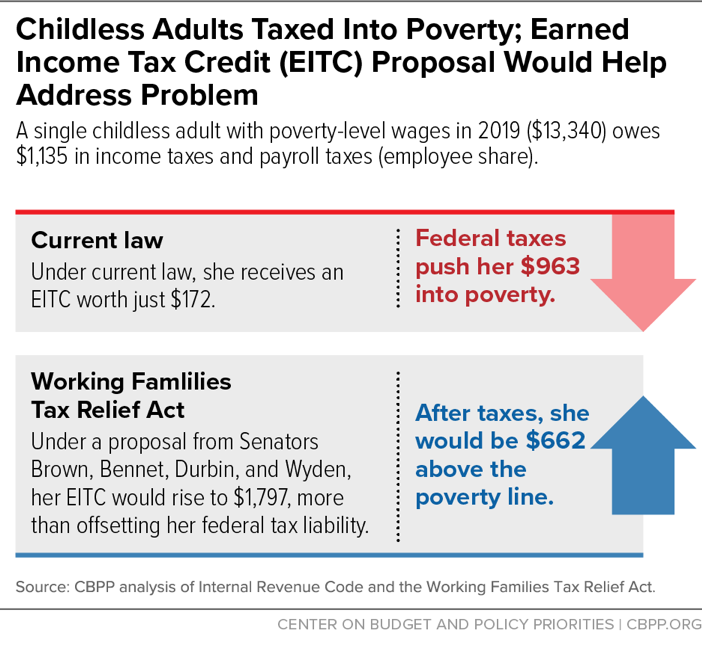

Childless Adults Are Lone Group Taxed Into Poverty Center On Budget And Policy Priorities

Working Families Tax Relief Act Provides Substantial Benefits And Misses Opportunity Tax Policy Center

Tax Relief What You Need To Know Community Tax

Tax Relief Apply For Federal Tax Relief Solutions That Work With The Irs

Tax Relief Shelby County Trustee Tn Official Website

Tax Relief How To Get It Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

Plain Talk What Do You Think Of This Proposal Exempting Most North Dakota Households From Income Taxes

Colleges Make Limited Use Of Available Pandemic Related Tax Relief

Covid 19 Relief Money Could Affect Your Taxes And What To Do About It

2022 Child Tax Credit What Will You Receive Smartasset

Victims Of Texas Winter Storms Get Deadline Extensions And Other Tax Relief Cd Bradshaw Associates P C

Flattening The Economic Curve The High Points Of Coronavirus Tax Relief

Brightside Tax Relief Home Facebook

Best Tax Relief Companies To Reduce Your Tax Debt Revised 2022