alameda county property tax rate

The valuation factors calculated by the State Board of Equalization and. The County of Alameda explicitly disclaims any representation and warranties including without limitation the implied warranties of merchantability and fitness for a particular purpose.

Alameda County Property Tax Tax Collector And Assessor In Alameda

Levy Rates by Tax District The assessed value of your property less any exemptions is the taxable value used to determine your taxes.

. Bill of Alameda County Property Tax. If the tax rate in your community has been established at 120 1 base rate plus 20 for prior indebtedness the property tax would be calculated as follows. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

You can review the levy rate of each district here. A convenience fee of 25 will be charged for a credit card transactions. The California sales tax rate is currently.

For comparison the median home value in Alameda County is. The penalty is 5 of the tax due. Provides the detail for the tax rate used in calculating that portion of your property tax bill based on the assessed value of your property.

Dear Alameda County Residents. Tax Rates for Alameda County The average percentage levied against properties is currently 0866 but Alameda County covers an extremely diverse area in terms of home price so. A message from Henry C.

The county tax rate is the same across the state of California. The California state sales tax rate is currently. If the tax due is not remitted within.

The median property tax in alameda county california is 3993 per year for a home worth the median value of 590900. The minimum combined 2022 sales tax rate for Alameda California is. Alameda County Property Taxes Range Alameda County Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount Maybe.

Many vessel owners will see an increase in their 2022 property tax valuations. The minimum combined 2022 sales tax rate for Alameda County California is. A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities schools and revenue districts that utilize the.

Tax Rate Areas Alameda County 2022. The County of Alameda Tax Collectors Office will determine and assess the utility users tax due plus penalties and interest. This is the total of state county and city sales tax rates.

Alameda Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount Maybe youre unaware that a real estate tax levy may. Subscribe to avoid late fees Email SMSText Message How to Pay Online A message from Henry C. Levy the Alameda County Treasurer-Tax Collector regarding the benefits of paying your Property Tax using the Alameda County E-Check System.

Alameda County California Sales Tax Rate 2022 Up to 1075 The Alameda County Sales Tax is 025 A county-wide sales tax rate of 025 is applicable to localities in Alameda County in. The median property tax also known as real estate tax in Alameda County is 399300 per year based on a median home value of 59090000 and a median effective property tax rate of. You can search for tax rates based on parcel number.

This means that every county including Alameda has a rate of 110 per 1000 of the assessed property value. The Alameda County California sales tax is 925 consisting of 600 California state sales tax and 325 Alameda County local sales taxesThe local sales tax consists of a 025 county. When you perform the previous step the property tax bill will be automatically downloaded and you will be able to rectify the alameda county.

This is the total of state and county sales tax rates.

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Alameda County Ca Property Tax Calculator Smartasset

Property Taxes Lookup Alameda County S Official Website

Acgov Org Alameda County Government

Alameda County Ca Property Tax Calculator Smartasset

Alameda County Ca Property Tax Search And Records Propertyshark

Property Tax Calculator Smartasset

Alameda County Ca Property Tax Calculator Smartasset

Alameda County Ca Property Tax Search And Records Propertyshark

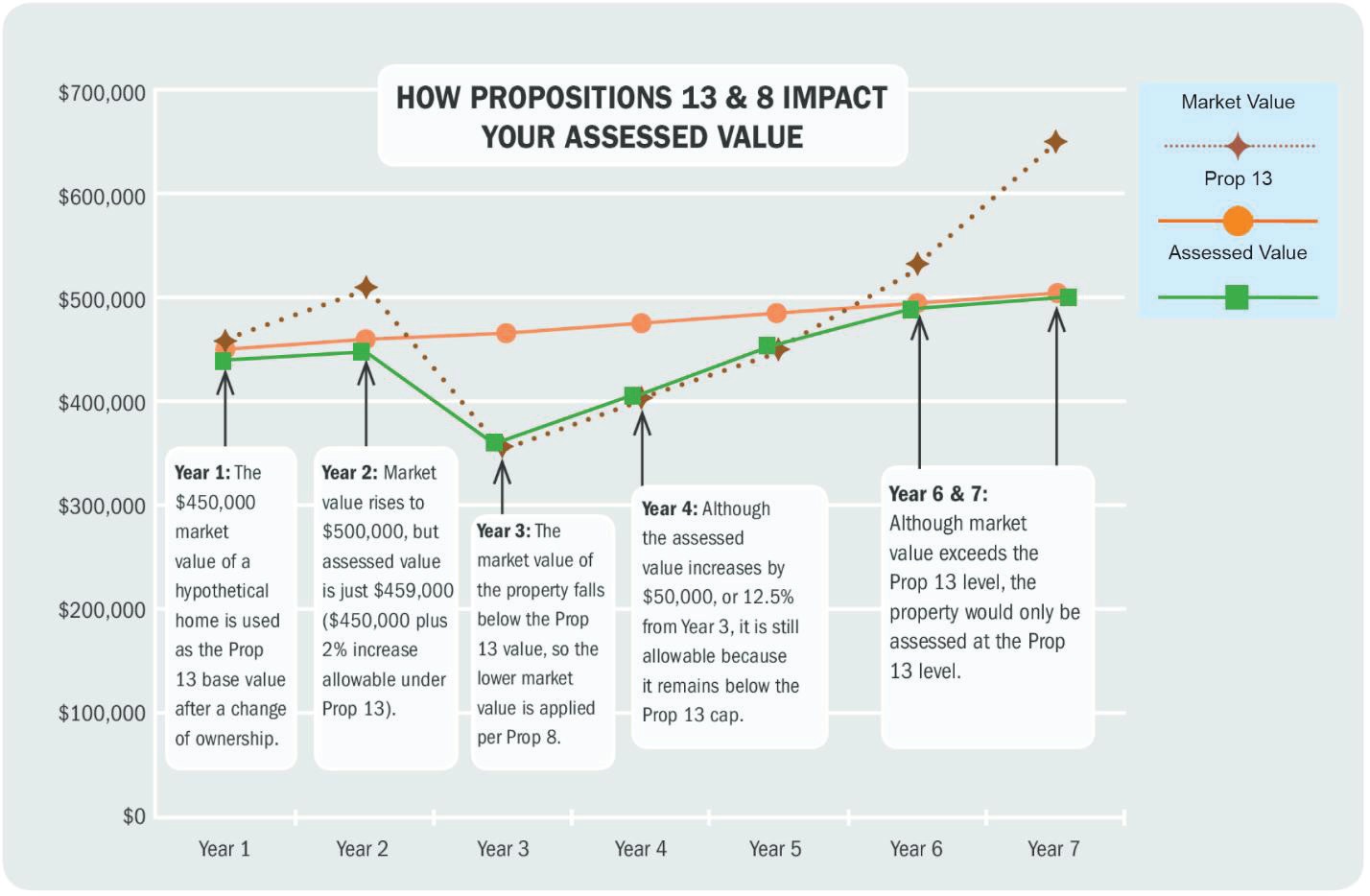

Understanding California S Property Taxes

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Property Tax Calculator Casaplorer

City Of Oakland Alameda County Calif Taxes 1884 Voucher Ebay

Shasta County Ca Property Tax Search And Records Propertyshark

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

California 2022 Sales Tax Calculator Rate Lookup Tool Avalara